rhode island property tax rates 2020

That number recently ticked up to 1474. 1463 for Real Estate and Tangible Property.

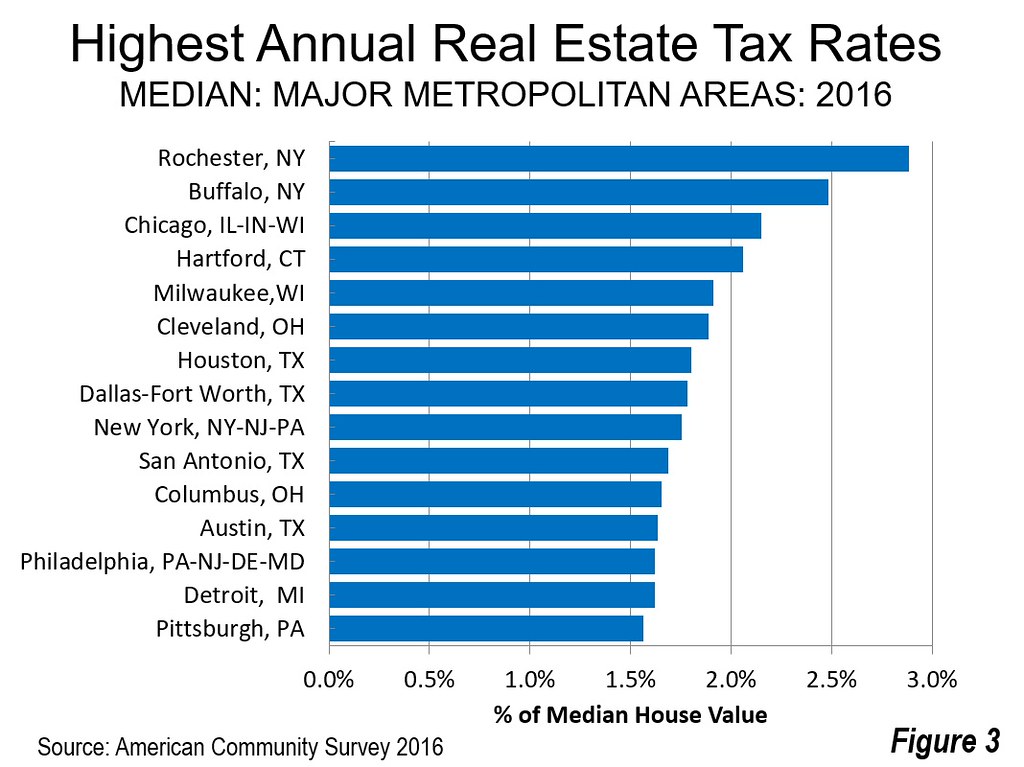

Property Taxes High In Ohio And Dayton L Dayton Business

Pensions Benefits Toggle child menu.

. Online Tax Bill Payment. Online Property Tax Database. The current tax rates and exemptions for real estate motor vehicle and tangible property.

Westerly has a property tax rate of 1152. Includes All Towns including Providence Warwick and Westerly. It kicks in for estates worth more than 1648611.

Initial Application for Senior or Disabled Tax Credit. The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. Real Tangible Tax Rate - 20211152 per 1000 Non-Sewer District1206 per 1000 Sewer DistrictMotor Vehicle Tax Rate - 20212967 per 1000 500 State Exemption and 4500.

41 rows Map and List of Rhode Island Property Tax Rates - Lowest and Highest. Narragansett has a property tax rate of 886. For tax roll year 2020 the property tax rate for Cumberland was 1432.

Ad Property Taxes Info. The top rate for the Rhode Island estate tax is 16. 135 of home value.

Property Tax Cap. Newport has a property tax rate of 933. FY 2021 Property Tax Cap.

2022 Tax Rates Per thousand dollars of assessed value based on 100 valuation. Online Property Taxes Information At Your Fingertips. Jamestown has a property tax rate of 828.

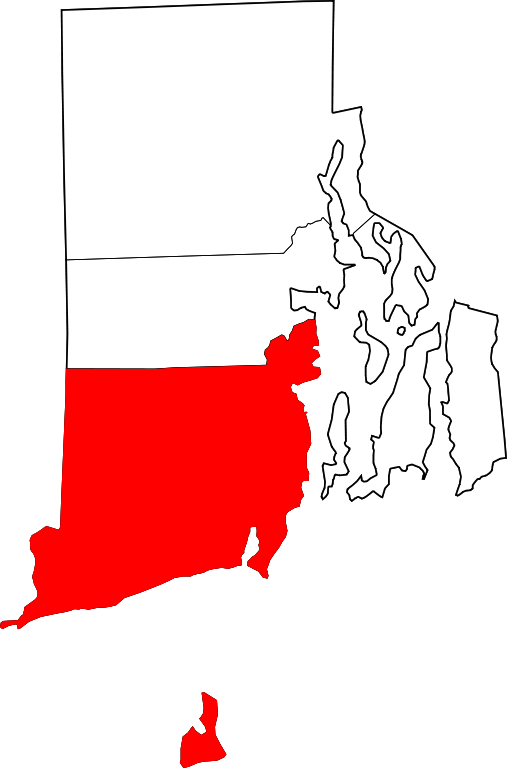

Recent Tax Rate History - Tax Rates from 1893 - 1996. Rhode Islands largest county by area and by population Providence County has the highest effective property tax rates in the state. FY2023 starts July 1 2022 and ends June 30 2023There was no increase in our tax rates from last year the tax rates remainResidential Real Estate - 1873Commercial.

Property Tax Cap. 2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily. The municipality of Burrillville also saw a notable rise in.

Tax amount varies by county. Monday - Thursday 830 am - 530 pm. Pensions Benefits Toggle child menu.

If you live in Rhode Island and are thinking about estate planning this. The countys average effective property tax rate is. FY 2020 Property Tax Cap.

FY 2019 Property Tax Cap.

How Do State And Local Property Taxes Work Tax Policy Center

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Map Of Rhode Island Property Tax Rates For All Towns

Pandemic Profits Netflix Made Record Profits In 2020 Paid A Tax Rate Of Less Than 1 Percent Itep

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

Lists Rhode Island Property Tax Rates

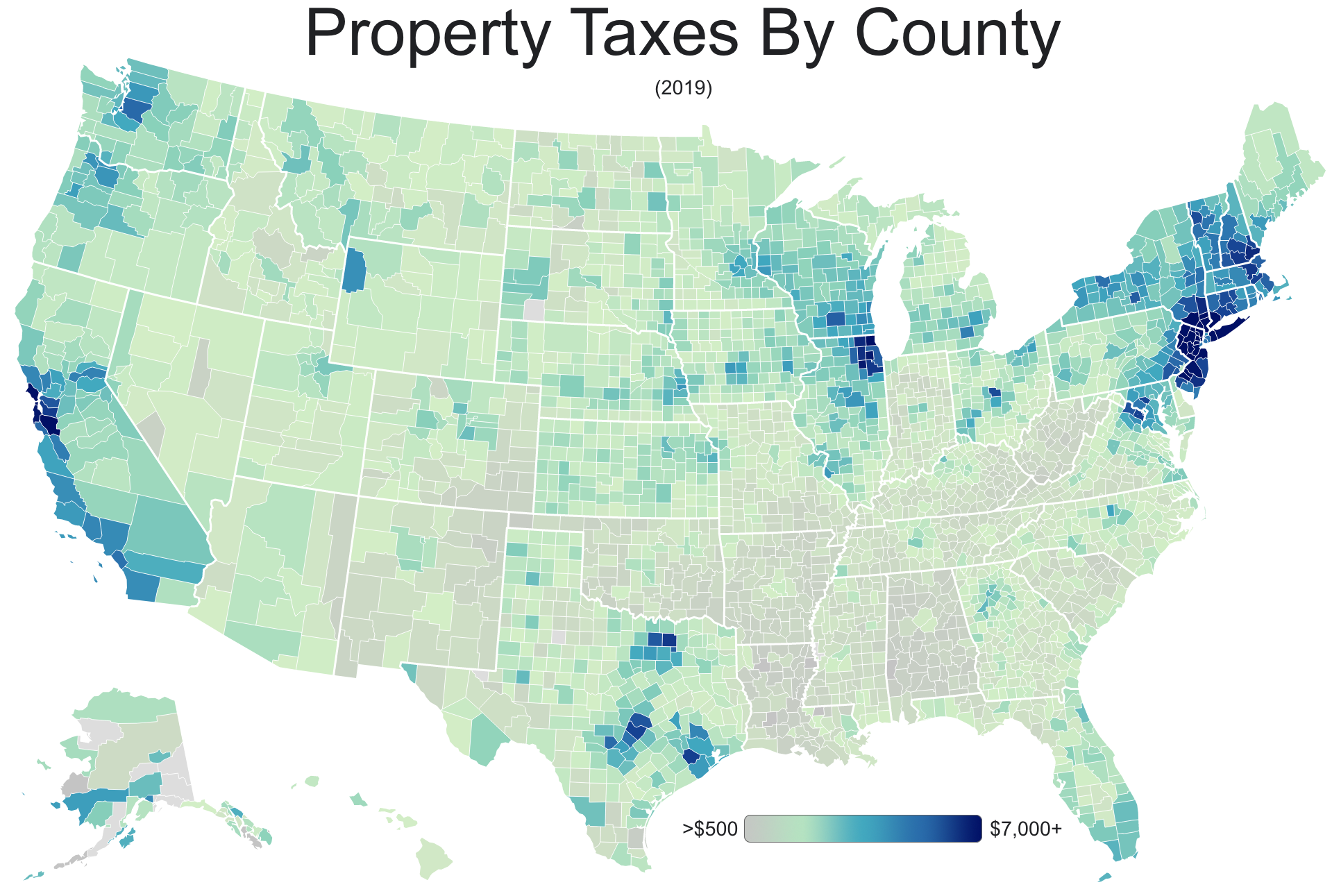

Property Taxes By County Interactive Map Tax Foundation

Map Of Rhode Island Property Tax Rates For All Towns

A Breakdown Of Washington County Rhode Island S Property Taxes For 2019 2020 Randall Realtors

2022 Property Taxes By State Report Propertyshark

Property Tax In The United States Wikipedia

Map Of Rhode Island Property Tax Rates For All Towns

Map Of Rhode Island Property Tax Rates For All Towns

Best Worst State Property Tax Codes Tax Foundation

Map Of Rhode Island Property Tax Rates For All Towns

Which U S States Charge Property Taxes For Cars Mansion Global

Rhode Island Sales Tax Rates By City County 2022

Rhode Island Income Tax Ri State Tax Calculator Community Tax